REPORTING MADE SIMPLE.

Contact usPayment Times Reporting

Expertise from designers of the scheme.

Designed by former regulators who know the frameworks inside-out.

Practical guidance that keeps pace with business decisions.

Tech-enabled solutions for modern compliance challenges.

“Payment Times Reporting is often overlooked as a meaningful way to build ESG credentials.It provides a rare opportunity for businesses to control the outcome and publicly walk-the-walk on fair dealing, community support, and sustainable growth of the Australian economy.”

How we help

Managed report preparation and submission

Data validation and methodology assurance

Client review and approval process

Regulator notices, remediation and response

Extensions of time and decision reconsideration

First-time registrant setup and onboarding

ESG strategy and stakeholder disclosure

Small business engagement and onboarding

Payment Times Reporting Resources

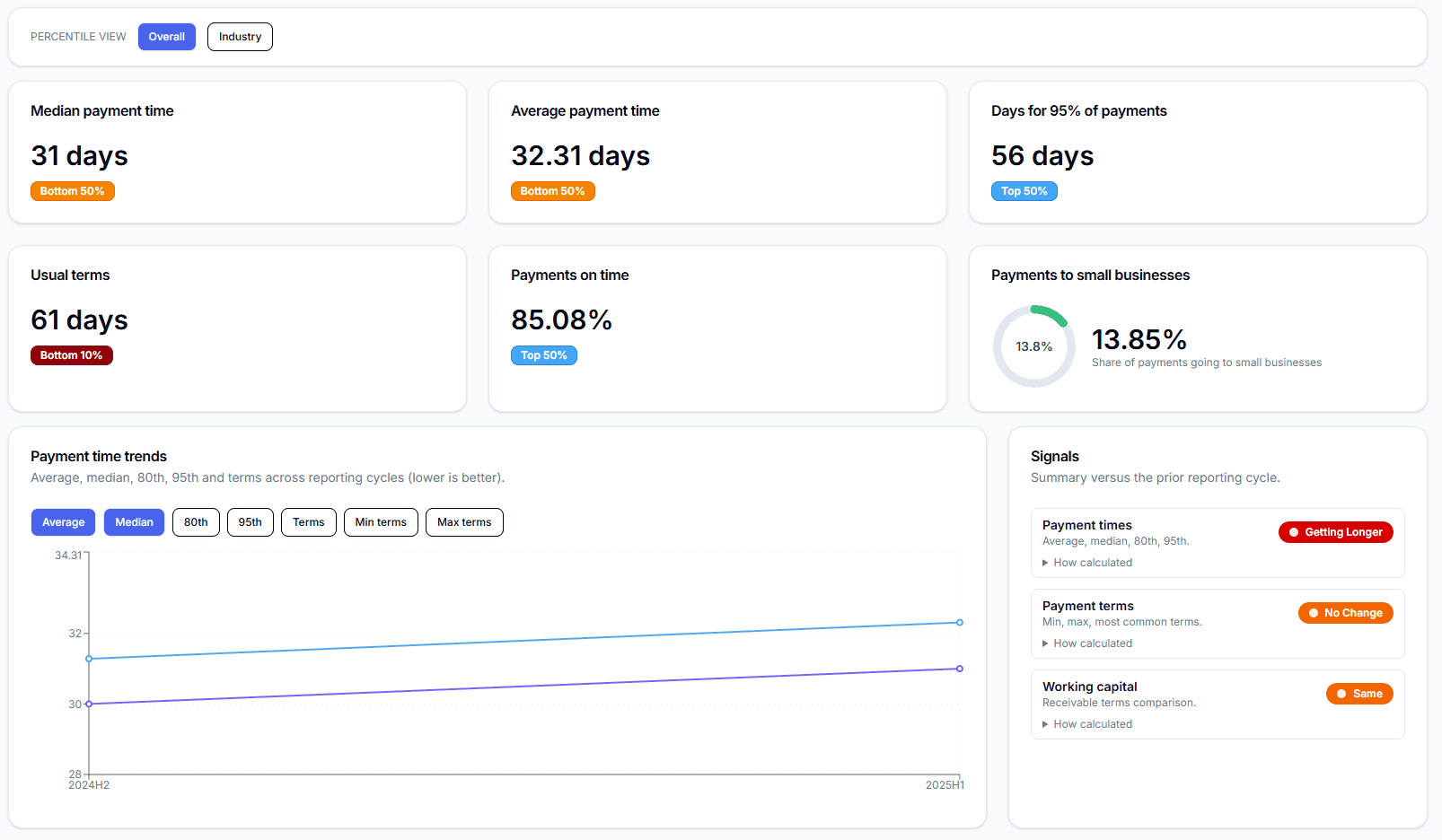

Search the Payment Times Report Register meaningfully.

Payment Times inFOCUS turns complex reporting data into clear, actionable insights.Access key metrics, compare entities, and benchmark your performance—fast. It's the smarter way to understand your position and stay ahead in a shifting compliance landscape.

Frequently asked questions

What specific expertise do you bring to Payment Times Reporting?

Our Principal led the team responsible for the 2024 legislative reforms at the Commonwealth Treasury. We offer unmatched insight into the scheme's design, compliance expectations, and reporting nuances.

How do you ensure our payment times reports are accurate and defensible?

We conduct pre-submission methodology and report reviews, checking for regulatory red flags and ensuring the underlying data, calculation, and reporting process aligns precisely with the Act and current regulatory guidance.

Can this reporting be leveraged for ESG purposes?

Absolutely. We position the Payment Times Report not merely as a compliance task but as an opportunity to publicly demonstrate ESG credentials related to fair dealing and community support.

Principal

Owen is a lawyer and Chartered Accountant with over 15 years experience in finance and regulation across the private and public sectors.